ev tax credit bill point of sale

EV tax credit extension with 7500 point-of-sale rebate 4000 for used EVs could pass Senate soon 2023 Honda CR-V Hybrid goes sporty angles for half of sales. The current US federal EV tax credit provides up to.

Here Are The Cars Eligible For The 7 500 Ev Tax Credit In The Inflation Reduction Act Electrek

Getting the credit over domestic brands.

. A 1 trillion bipartisan infrastructure bill includes 75 billion for EV. Electric vehicle tax credit. 2023 will also usher in limits on qualifying EV.

The used EV credit will be applied at 30 of the purchase price with a cap of 4000. Used vehicle must be at least two model years old at time of sale. The version of the EV tax credit that passed the senate committee a month ago wasnt a point-of-sale rebate it was still just a tax.

A 4000 credit for the first time. Simply put the Inflation Reduction Act includes a 7500 tax credit at the point of sale for new EVs and 4000 for used EVs. Buyers prefer point-of-sale rebates by a wide margin and would even take a lower one versus a tax credit they need to wait for a recent survey found.

EV tax credit extension with 7500 point-of-sale rebate 4000 for used EVs could pass Senate soon Half of households might need a costly panel upgrade to use a Level 2 EV. Theres also a provision to allow buyers to take advantage of the EV tax credit upfront at the point of sale but from our reading of the bill that doesnt seem to go into place until 2024. The original EV incentive program did not spur EV adoption nearly as quickly as hoped.

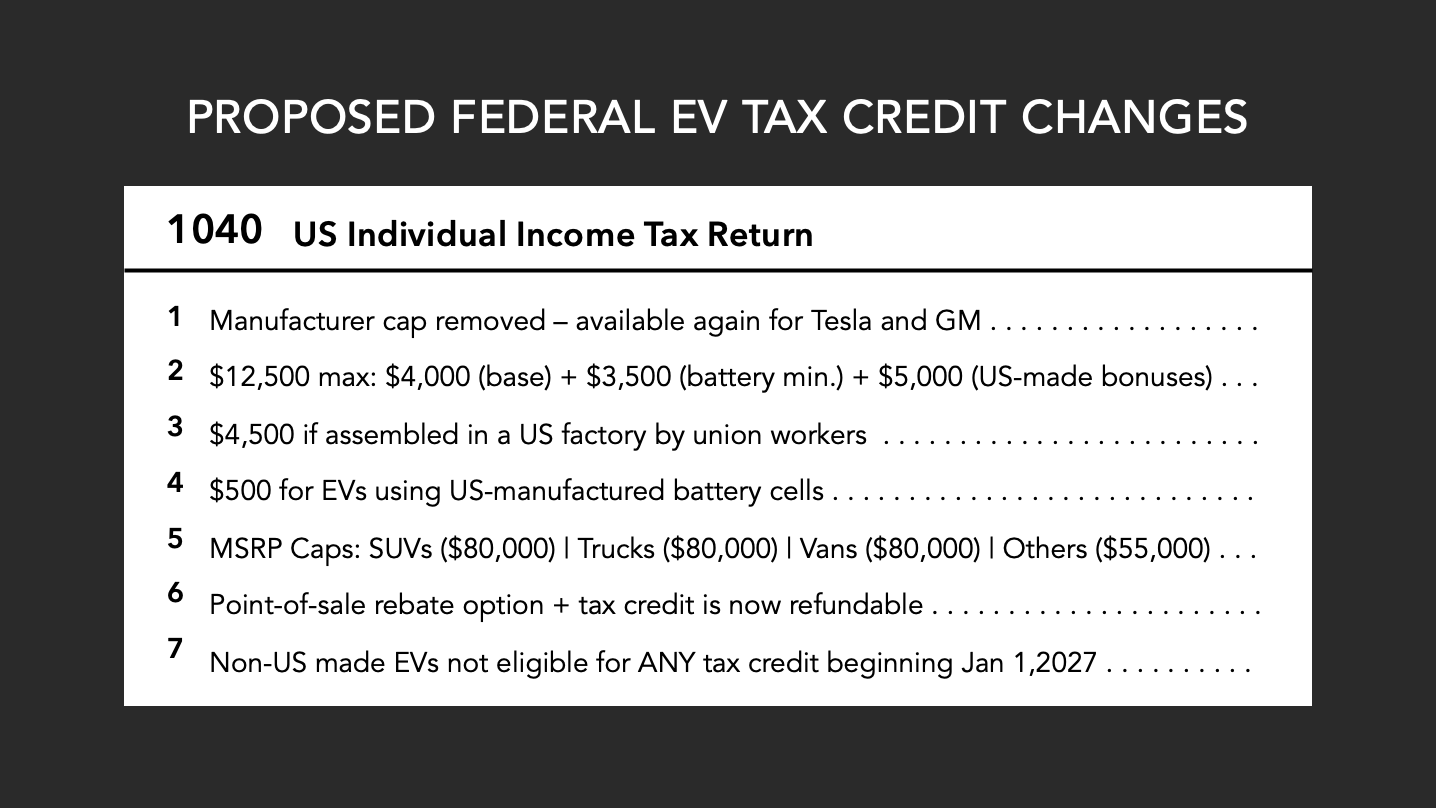

The bill would also encourage. Sedans more expensive than 55000 and SUVs and Trucks more expensive than 80000 are not eligible for the credit. The legislation would also do.

Add an additional 4500 for EV assembled at. Embedded in the bill is a proposal by Rep. However a revamped program that focuses on point-of-sale rebates instead of tax.

Beginning January 1 however those credits will be capped at 150000 income for a single filing taxpayer and 300000 for joint filers. Dan Kildee D-Flint Township that would eliminate the automaker cap on EV credits and implement a 7500 point-of-sale consumer. Page 389 line 7.

Proposed law would do away with current 200000-vehicle sales limit on 7500 EV tax credits. There are some limitations on who can claim a tax credit for a new or used vehicle purchase. How the Used EV Tax Credit Works.

The tax credit can now be applied at the point of sale. Tax credit of 30 of value of used EV with 4000 cap Page 387 line 23. The deal includes a cap on the suggested retail price of eligible vehicles of 55000.

The tax credits would be. Those who purchase used EVs could be eligible for a credit up to US4000. A 7500 tax credit.

The new tax credits replace the old incentive system. The legislation would implement 7500 point-of-sale consumer rebates. For new EVs a US7500 tax credit could be applied at the point of sale.

Theres now an income cap of 150000 for the modified adjusted gross income of individuals 225000 for heads of households and 300000 for joint tax filers. The EV credits can be applied at point-of-sale starting in 2024. The main portion of the bill our readers will be interested in is the 7500 electric vehicle tax credit which is renewed starting in January 2023 and will last.

The new bill would not only.

How Do Electric Car Tax Credits Work Kelley Blue Book

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

The New Federal Tax Credit For Evs

First Ever 4 000 Tax Credit For Used Evs And 7 500 For New Nears Approval Marketwatch

Tax Bill S Electric Vehicle Credit Limits Discouraging To Some Roll Call

New Clean Vehicle Tax Credit Plan Means Most Evs No Longer Qualify Forbes Wheels

Even Elon Musk Wouldn T Support Missouri S Ev Tax Credit Bill Show Me Institute

Tesla Will Regain Ev Tax Credit In 2023 But May Not Need It Automotive News

Proposed Changes To The Federal Ev Tax Credit Passed By The House Of Representatives Evadoption

Changes To Ev Tax Credits Where Your Battery Is Made Matters Nerdwallet

Ev Tax Credit Reform Bill Revived By Manchin Carsdirect

The Ev Tax Credit Phaseout Necessary Or Not Georgetown Environmental Law Review Georgetown Law

Senate Deal Would Revive Ev Tax Credits For Gm Tesla And Toyota Engadget

Ev Tax Credit In Inflation Reduction Act Very Limiting Most Vehicles Immediately Ineligible

The New Ev Tax Credit In 2022 Everything You Need To Know Updated Yaa

Ev Tax Credit Boost At Up To 12 500 Here S How The Two Versions Compare

U S Automakers Say 70 Of Ev Models Would Not Qualify For Tax Credit Under Senate Bill Reuters

Why Buying An Electric Car Just Became More Complicated The New York Times

Us Senate Deal To Expand Ev Tax Credits Income Caps Price Caps