richmond property tax rate 2021

Year Municipal Rate Educational Rate Final Tax Rate. Browse Current and Historical Documents Including County Property Assessments Taxes.

About Your Tax Bill City Of Richmond Hill

Yearly median tax in Richmond City.

. When contacting City of Richmond about your property taxes make sure that you are contacting the correct office. 802 Lemon Twist Ln is a 5 Beds 4 Full Bath s property in Richmond TX 77406. 10249 Staff Recommendation 1.

Fiscal Year 2021 - Tax Roll Year 2020 tax rate per thousand dollars of assessed value. Tax Rate per 100 of assessed value Albemarle County 434 296-5856. Ad Research Is the First Step to Lowering Your Property Taxes.

This information pertains to tax rates for Richmond VA and surrounding Counties. Between 3M to 4M. Taxpayers who pay within the first 20 days on or by Sept.

Broad St Room 802 Richmond VA 23219 USA. In Richmond motor vehicles are assessed at 80. The real estate tax rate is 120 per 100 of the properties assessed value.

Richmond City has one of the highest median property taxes in the United States and is. Twenty-six counties had a revaluation in 2019 and 12 counties have one in 2020. Richmond City collects on average 105 of a propertys assessed fair market value as property tax.

FY 2021 Rhode Island Tax Rates by Class of Property. Vehicle License Tax Antique. 2021 Richmond Millage Rates.

MUNICIPALITY NOTES RRE COMM PP MV. The new assessments will be used to calculate tax bills mailed to city property owners next year. Vehicle License Tax Vehicles.

View photos map tax nearby homes for sale home values school info. April 7 2021 File. The average property tax rate is now 6760 compared to 6785 last year a 035 decrease statewide.

Understanding Your Tax Bill. Richmond County currently performs a General Reassessment every four 4 to. Annual Property Tax Rates 2021 Bylaw No.

What is considered real property. Enter Your Address to Begin. Tax bills are mailed out on July 1st and December 1st and are due on September 30th and February 28th.

West Warwick taxes real property at four distinct rates. Amelia County 804 561-2158. Tax Sales Property Auction.

10249 be introduced and given first second and third readings. Average Property Tax Rate in New Richmond. Tax Rate 2062 - 100 assessment.

What is the real estate tax rate for 2021. Over 4M 4 1000 of assessment value over 4M 0004 City of Richmond 2021 TAX RATES New Additional School Tax for Qualifying Residential Properties. That the Annual Prope1ty Tax Rates 2021 Bylaw No.

2989 - two to five family residences 3243 - commercial I and II industrial commind. Due Dates and Penalties for Property Tax. Real estate taxes are due on January 14th and June 14th each year.

Real Estate Tax Frequently Asked Questions FAQs What is the due date of real estate taxes in the City of Richmond. The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800. Toronto Property Tax 2021 Calculator Rates Wowa Ca Parking tickets can now be paid online.

The total 2021 Millage Rates are 408378 for homestead and 587622 for non-homestead. Residential Property Tax Rate for Richmond Hill from 2018 to 2021. Bills paid after November 15th will incur interest charges.

Even though higher. Vehicle License Tax Motorcycles. Municipal Finance Authority 250-383-1181 Victoria.

That the Annual Prope1ty Tax Rates 2021 Bylaw No. Greater Vancouver Transportation Authority TransLink 604-953-3333. Based on latest.

For information and inquiries regarding amounts levied by other taxing authorities please contact them directly at. Ultimate New Richmond Real Property Tax Guide for 2021. Taxpayer Property Account Information.

BARRINGTON 2090 2090 2090 3500 BRISTOL 1407 1407 1407 1735 BURRILLVILLE 1601 1601 1601 3500 CENTRAL FALLS 8 2369 3795 6993 3500 CHARLESTOWN 2 823 823 823 1308 COVENTRY 2 7 1897 2287 1897 1875 CRANSTON. In Scituate motor vehicles are assessed at 95. Manage Your Tax Account.

102 rows Fifteen counties had a tax rate change in 2020-21 with four counties increasing and eleven counties decreasing their rate. Real Property residential and commercial and Personal Property. Town of Richmond 5 Richmond Townhouse Road Wyoming RI 02898 Ph.

2 1000 of assmt value between 3M to 4M 0002 Tier 2. Tax bills which are usually mailed in mid-September will retain their same due date of November 15th. To view previous years Millage Rates for the City of Richmond please click here.

Province of BCs Tax Deferment Program. 30 2021 will receive a 1 discount on the tax portion of their bill a perk that is shared by only a few counties in Georgia. Car Tax Credit -PPTR.

June 5 and Dec. With our resource you will learn useful information about New Richmond property taxes and get a better understanding of what to consider when you have to pay. Paying Your Property Taxes.

Richmonds real estate tax rate is 120 per 100 of assessed value. 105 of home value.

Soaring Home Values Mean Higher Property Taxes

Ontario Property Tax Rates Lowest And Highest Cities

New York City Property Tax Rate Is It Worth Selling

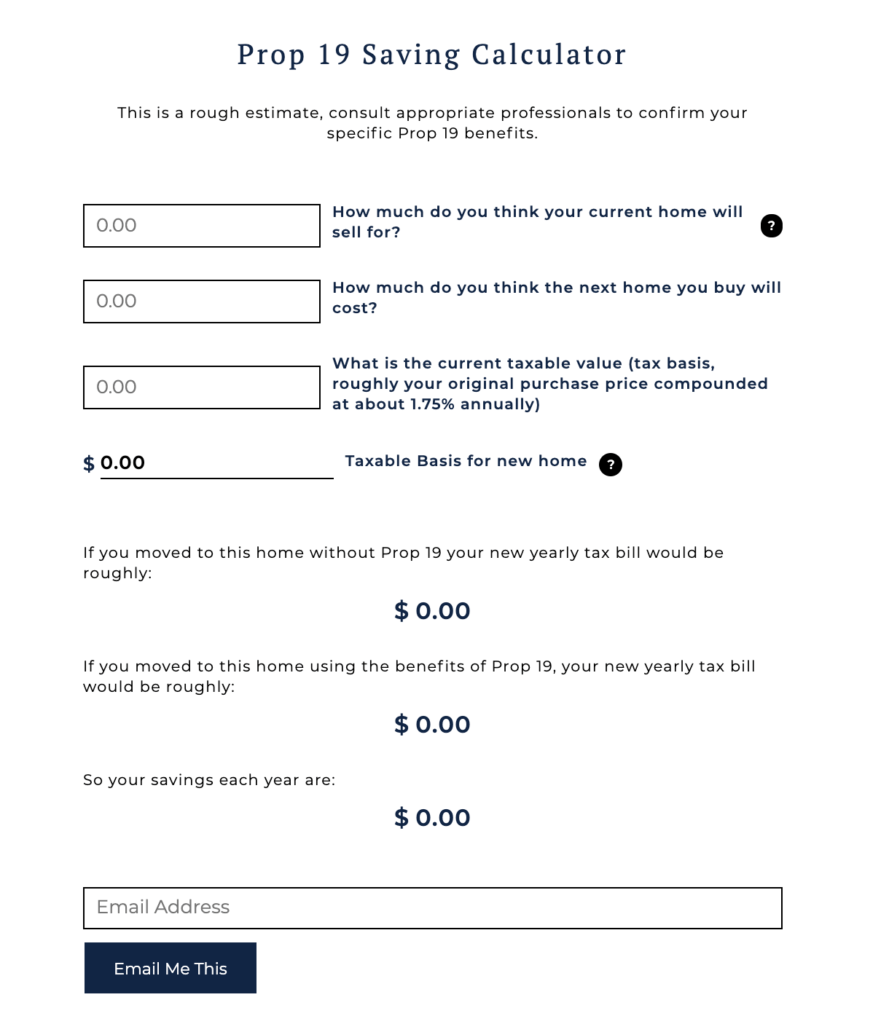

Not All Senior Citizens Still Qualify For Ohio Property Tax Discounts Homestead Savings Calculator Cleveland Com

Richmond Ky Taxes Incentives Richmond Industrial Development Corporation

Ontario Property Tax Rates Lowest And Highest Cities

What Is The Property Tax Rate In Richmond Tx Cubetoronto Com

Finance Taxes Augusta Economic Development Authority

Tax Bill Information Macomb Mi

Property Tax North Carolina Association Of County Commissioners North Carolina Association Of County Commissioners

Millage Rates Richmond County Tax Commissioners Ga

City Of Richmond Adopts 2022 Budget And Tax Rate

Using His Luxury Horse Farm To Dodge Property Taxes Glenn Youngkin Is Sounding More And More Like His Idol Donald Trump Every Day Blue Virginia

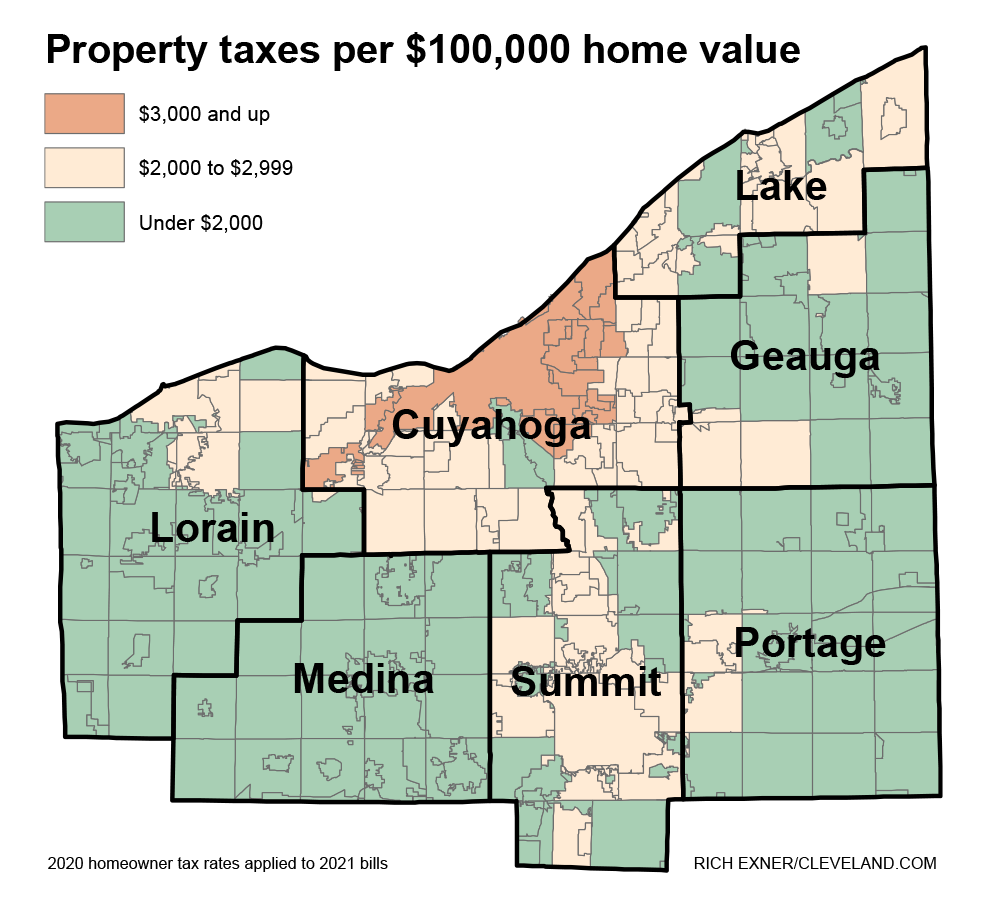

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

Richmond Hill Property Tax 2021 Calculator Rates Wowa Ca

Vermont Property Tax Rates Nancy Jenkins Real Estate